SEPTEMBER 2025 | MONTHLY PRESS COVERAGE ROUND-UP

Hot off the press: our newest media mentions.

Hot off the press: our newest media mentions.

ADRIAN ANDERSON 30.09.2025

MORTGAGE INTRODUCER | CHATGPT-5 HAS LANDED BUT BROKERS REMAIN WARY

Within the mortgage sector, brokers are already exploring practical applications. Harry Arnold, Director at Anderson Harris, observes that the technology can save time when sourcing property details such as EPC ratings or council tax bands, checking unusual medical disclosures for insurance, or calculating the impact of overpayments. “None of these are game-changing in isolation,” he notes, “but collectively they can save precious time each day.”

Read the full article here: https://www.mpamag.com/uk/news/general/chatgpt-5-has-landed-but-brokers-remain-wary/546230

yahoo! finance | what the budget could mean for stamp duty and council tax

Stamp duty and council tax have been identified as areas in need of improvement for very different reasons. “Stamp duty is widely viewed as inefficient and distortionary,” explains Adrian Anderson, Managing Director of Anderson Harris. “It discourages mobility (people staying in houses longer than they otherwise would) and imposes a big one-off cost.”

Twenty years ago, the rate of stamp duty buyers paid was much smaller than the value of their property; now, thanks to higher rates and rising property prices, particularly in London and the South East, it’s a significant chunk of what a buyer is expected to budget for.”

AUGUST 2025 | MONTHLY PRESS COVERAGE ROUND-UP

Browse our freshest mentions across leading publications.

Browse our freshest mentions across leading publications.

ADRIAN ANDERSON 31.08.2025

THE TIMES | MORTgage rates drop in sign that crisis may be over

Adrian Anderson, from the broker Anderson Harris, said the rate cut was good news for all homebuyers and those looking to remortgage and he hoped to see further cuts in rates throughout the year. “It does feel like we are on the path to cheaper mortgage rates, where the costs are going to get cheaper, which will help with market confidence and affordability,” he said. “I guess the hope is that by the end of the year we could be getting closer to 3.5 per cent.”

Read the full article here: https://www.thetimes.com/business-money/money/article/mortgage-rates-drop-in-sign-that-crisis-may-be-over-8zfrkxqx2

MORTGAGE INTRODUCER | INSIDE THE SOCIAL MEDIA STRATEGY OF A HIGH-END MORTGAGE BROKER

Harry Arnold explains how Anderson Harris is using Instagram and LinkedIn to build business credibility. “We actually did a full rebrand before launching our social media strategy,” Arnold said. “The idea was to bring our visual identity in line with the clients we serve.” With a growing number of wealth managers and private banks establishing strong digital presences, Arnold and his team saw an opportunity to do the same.

The firm has found a balance between two key platforms. “Instagram is more directed at direct clients and also to potential mainly property related introducers... it's much more brand led and it's a lot more consumer driven,” Arnold said. “LinkedIn is more [about] keeping in contact with our network of people we already know.”

“That's why we see social media as part of a larger strategy. We did our website, we've invested heavily in reviews... we spent a lot of money and, for example, all of the imagery for the business is bespoke and meant to reflect our clients and client profiles and the areas of London and the areas of the country that they live and the types of houses they buy. So it's all meant to be a whole thing.” - Harry Arnold, Director

Read the full article here: https://www.mpamag.com/uk/mortgage-types/residential/inside-the-social-media-strategy-of-a-high-end-mortgage-broker/544815

THE TIMES| HOW THE TOP TAX RATE BECAME A MIDDLE-CLASS PROBLEM

“The general feeling I get now from clients earning £125,140 a year is that they feel worse off in real terms than they were in 2015. People face higher taxes, higher interest rates and higher basic living expenses, so they have less disposable income.

I used to see additional-rate taxpayers sending children to private school, but now it feels like both parents have to earn a six-figure salary to manage school fees and higher mortgage costs.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/how-the-top-tax-rate-became-a-middle-class-problem-jsjv09sn0?utm_source=chatgpt.com

THE TIMES | mortgage prices are falling - should you fix?

“A lot of the banks are fighting for market share. Many will be behind their annual targets because purchase transactions are down, so they will want to try and entice people to take a mortgage with them and increase their loan book.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/mortgage-prices-borrowers-rates-x90qwxn9k

JULY 2025 | MONTHLY PRESS COVERAGE ROUND-UP

Explore our latest press mentions.

Explore our latest press mentions.

ADRIAN ANDERSON 31.07.2025

THE TIMES | I’m downsizing into my daughter’s garden, but what if my house won’t sell?

“Downsizing from a big house to a lodge in your daughter’s garden is a commendable plan. It could offer you greater financial freedom, fewer maintenance demands and a closer connection with your family. As with any property move, though, timing the sale of your current home to align with your plans can be difficult, especially in a slow market. A bridging loan could be helpful, but it’s essential to understand exactly what it involves. It is a short-term loan designed to bridge the gap between selling your property and buying or building a new one. While it may sound straightforward, bridging finance is a specialist area with its own risks and requirements. Your exit strategy will be key. Most lenders want to see a clear plan (typically the sale of your home) and a realistic timeframe for repayment. If the sale is delayed, you could face pressure to repay or incur penalties. A bridging loan may not be your only option here. You could negotiate a delayed payment with your lodge builder or draw on other financial resources such as savings, investments or family support.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/im-downsizing-into-my-daughters-garden-but-what-if-my-house-wont-sell-7hl29whd7

THE TELEGRAPH | HOUSE PRICE GROWTH TO HALVE AS SELLERS FLOOD THE MARKET

“It has felt like a buyers’ market for quite a while now, and with such a high level of properties for sale, it is not surprising that the asking prices have reduced. Temporary cuts in stamp duty in April this year has had a negative impact on property values. Sellers are often over optimistic with their initial asking prices. With the increase in available stock for sale, sellers are having to be more realistic.” - Adrian Anderson, Managing Director

Read the full article here: https://www.telegraph.co.uk/money/property/house-prices/house-price-growth-halve-sellers-flood-market/?utm_source=chatgpt.com

JUNE 2025 | MONTHLY PRESS COVERAGE ROUND-UP

See what the press is saying about us in this month’s headlines.

See what the press is saying about us in this month’s headlines.

ADRIAN ANDERSON 30.06.2025

THE TIMES | HOW CAN I RELEASE EQUITY FROM MY HOME TO PAY FOR SCHOOL FEES?

“Using your mortgage to release equity from your home for renovations, school fees or consolidating debt can be a practical financial decision — but it’s essential to weigh the benefits and long-term implications carefully.

When lenders carry out affordability assessments they usually have to consider any outgoings for school fees, which may limit how much you can borrow. But if you are raising funds to pay for school fees, the lender may exclude this outgoing, meaning you may be able to borrow more, although only a limited number of lenders will consider this.

When making your decision, consider whether it’s more cost-effective to raise funds through a further advance on your existing mortgage deal or a full remortgage. Compare the present interest rate with the new one you would get, and look into any early repayment charges and the costs associated with switching lenders. Always assess the fees charged and the length of the mortgage, as these factors impact the overall amount you will pay.

If you’re looking at an interest-only mortgage, be mindful that while these may come with lower monthly payments, you’ll need a robust repayment strategy for when the deal ends. This is because the capital isn’t reduced over time and you will need to pay it off as a lump sum.

Releasing equity may be a sensible way to fund improving your home, funding education or streamlining debt, but it’s not without risks. The right approach depends on your priorities, financial position, and a clear understanding of the long-term costs and short-term benefits. With careful planning and expert advice from a qualified mortgage adviser, you can ensure that your borrowing decision strengthens your financial position rather than undermines it.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/how-can-i-release-equity-from-my-home-to-pay-for-school-fees-0ngxsztt0

THE TELEGRAPH | MAJOR LENDERS RAISE MORTGAGE RATES AHEAD OF REEVES’S SPENDING REVIEW

“I’m not surprised some lenders have increased rates because the cost of borrowing has increased slightly. Markets will be looking closely at the spending review. Rachel Reeves needs to strike a delicate balance between not upsetting the bond market while also not upsetting voters. If it looks like she is going to have to borrow more, that will impact swap rates.” - Adrian Anderson, Managing Director

Read the full article here: https://www.telegraph.co.uk/money/property/mortgages/major-lenders-raise-mortgage-rates-ahead-of-reevess-spendin/?utm_source=chatgpt.com

THE TELEGRAPH| THE homes selling at a £5m discount

“Asking prices are often quite out of sync with reality. Some owners are still expecting to get the prices they could have got during the ‘hot’ Covid market. Many sellers also don’t have to sell. So if someone comes along and pays what they want, they’ll take the offer. Otherwise, they’ll just stay put.” - Adrian Anderson, Managing Director

Read the full article here: https://www.telegraph.co.uk/money/property/house-prices/homes-britain-selling-5m-discount/

YAHOO! FINANCE| how school fees can affect your mortgage borrowing

“In some cases, splitting the funds to maintain both a strong deposit and a ring-fenced education pot is a balanced approach. A qualified mortgage intermediary will be able to help you carry out the pros and cons of each option.

Generally, mainstream high-street lenders tend to be stricter in how they treat school fees, applying them fully as committed outgoings.” - Adrian Anderson, Managing Director

MAY 2025 | MONTHLY PRESS COVERAGE ROUND-UP

Take a look at our recent press buzz and see how we’ve been making headlines this month.

Take a look at our recent press buzz and see how we’ve been making headlines this month.

ADRIAN ANDERSON 31.05.2025

THE TIMES | SHOULD I DITCH MY TRACKER MORTGAGE AND LOCK IN?

“This month the Bank of England reduced the base rate from 4.5 per cent to 4.25 per cent, which was good news for mortgage borrowers. The markets are predicting more interest rate cuts this year and next. In a fight for more customers, banks and building societies are competitively pricing their fixed-rate mortgages at the moment. It’s not surprising, then, that many borrowers with variable tracker mortgages are questioning their position. It’s essential to consider any exit fees on your tracker deal (as not all are penalty-free), and the arrangement fees and any other costs, for the new mortgage. Most lenders are trying to keep customers, so be sure to compare the deals from your current lender and those of other firms. Ultimately the decision to switch from a tracker to a fixed-rate mortgage hinges on your personal circumstances around financial stability, risk appetite. Staying on a tracker could yield savings in the long term if rates fall as predicted, but fixing now will probably get you a cheaper rate in today’s market - and peace of mind.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/should-i-ditch-my-tracker-mortgage-and-lock-in-3w9pw85rx

THE TIMES | HOW TO MAKE YOUR RETIREMENT DREAM A REALITY?

“Increasing your monthly repayments when you get a salary increase, instead of spending it on your lifestyle or holidays, will pay down the dept much quicker. Choosing a capital repayment mortgage, rather than one that just repays the interest, and opting for a shorter term can make a big difference in being able to retire free of dept. We advise clients to make lump sum payments off the mortgage when they have cash available because even small extra one-off payments can reduce interest over the term. It is also important to shop around for the best mortgage rate because a lower intrest rate can save you thousands over the lifetime of a deal. It is usually possible to overpay up to 10 per cent of the mortgage balance each year without the lender charging a penalty, and this could be the best use of any spare cash if savings rates are much lower than mortgage rates.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/how-to-make-your-retirement-dream-a-reality-h9r3vb7lk#:~:text=Stopping%20work%20early%2C%20living%20debt,to%20manifesting%20your%20perfect%20retirement

THE TIMES | THE RISE OF THE JUMBO HOUSE DEPOSIT

“I’ve seen clients in the last six months who have had £800,000 or even £1 million deposits. Many parents of borrowers are telling us that one of the main reasons they are gifting money is due to worries about inheritance tax (IHT). Families are genuinely concerned about this. 40-50% of first-time buyers we deal with now have jumbo deposits and this has increased significantly over the past years.” - Harry Arnold, Director

Read the full article here: https://www.thetimes.com/business-money/money/article/the-rise-of-the-jumbo-house-deposit-mrxvkdtb7

THE TIMES | WE’RE SIBLINGS AND BOUGHT A HOUSE TOGETHER - HERE’S HOW WE DID IT

“It’s really difficult to buy on your own because of rising house prices - you usually need two incomes to afford it, which is why we see a lot of people who aren’t buying with a partner buying with a sibling. One of the most important factors to consider is deciding what type of mortgage to take out. Fixed-term mortgages are popular among first-time buyers because they give you peace of mind knowing what your monthly repayments will be over a longer period of time. While most people like the security of a five-year fix, if you want to leave early you might be stung with early exit penalties that can be between 1 and 5 per cent of the outstanding loan.” - Adrian Anderson, Managing Director

Read the full article here: https://www.thetimes.com/business-money/money/article/were-siblings-and-bought-a-house-together-heres-how-we-did-it-5089lj55v

What You Need to Know about the upcoming stamp duty changes this April

With important changes to Stamp Duty rates on the horizon this April, it's crucial to stay informed. In this newsletter, we'll cover everything you need to know to navigate these changes effectively. Whether you're buying your first home, investing in property, or just keeping up with the market, we've got the insights to keep you ahead.

Capital & Interests: Upcoming Stamp Duty Changes: What You Need to Know

ADRIAN ANDERSON 03.02.2025

On The First Of April

Changes to the Stamp Duty thresholds are set to take effect, marking a shift in the UK property market. These adjustments, announced by Rachel Reeves in last year’s budget, will see the end of temporary relief measures introduced by the Conservatives. This change will affect everyone planning to move - and will mean higher costs for many buyers, but particularly first-time buyers. Here’s what these changes mean and how to prepare.

What is Stamp Duty?

Stamp Duty, or Stamp Duty Land Tax (SDLT), is a tax paid by property buyers in the UK. It’s a one-off payment made when the purchase is finalised. How much you’ll need to pay depends on a few things, like whether you’re a UK resident, a first-time buyer, replacing your main home, purchasing an additional property, or buying through a company. It only applies to properties or land that costs more than a certain amount.

Three years ago, the government lowered the upfront costs of moving home by temporarily changing the thresholds of stamp duty. They did this in the hope that it would support the housing market, and help those who were hoping to get on the housing ladder.

What are the Changes?

The temporary increase to Stamp Duty thresholds are about to be withdrawn, with the lower threshold reduced from £250,000 to £125,000. For first-time buyers, the threshold for zero Stamp Duty will also fall, from £425,000 to £300,000. Properties priced between £300,000 and £500,000 will attract a 5% rate, while any portion above £500,000 will incur standard rates.

So what does that mean? Many first-time buyers will be paying more Stamp Duty than they have in recent years, particularly in high-demand areas where property prices exceed the £300,000 threshold. For second home buyers, landlords, and companies, the additional 3% SDLT payable has already increased to 5% from October 2024.

A Surge in Market Activity

As the deadline approaches, we are seeing a surge of activity in the property market, as buyers rush to complete transactions under the current thresholds, before the changes take effect. We are seeing increased competition for properties in certain price brackets, competition for properties and added pressure on conveyancers, solicitors and lenders to meet tight timelines.

After the changes are implemented, the market may see a slowdown in activity, with higher SDLT rates deterring buyers - particularly first-time buyers. For those who are unable to complete their purchase before April, there may be opportunities to negotiate lower property prices if demand temporarily cools - but the overall affordability of homes remains a significant challenge, and the return to pre-2021 SDLT thresholds is likely to only exacerbate this issue.

How Buyers will be Affected

First-Time Buyers: Many will now pay Stamp Duty on properties previously exempt under the temporary measures - losing access to higher tax-free thresholds means this group will see the greatest negative impact from the adjustments.

Second Home Buyers, Landlords, and Companies: These groups will continue to face higher SDLT rates, making strategic planning crucial for any investments.

Actions to Take Now

If you’re planning to buy, here’s how to minimise the impact of these changes:

Move Quickly: Begin the buying process now to maximise your chances of completing your transaction under the current thresholds. Delays can be costly, so acting swiftly is essential.

Engage Professionals Early: Work closely with solicitors, conveyancers, and lenders to streamline the process. Engaging with this early will help you get all your paperwork in order, and will reduce the risk of missing the 31st March deadline.

Prepare for Negotiations: Ensure your finances are in order, to make swift offers and secure your mortgage. If you anticipate missing the deadline, be ready to negotiate on pricing to secure a fair deal under the new regime.

Staying Informed

As these changes unfold, staying informed and proactive is crucial. Understanding the evolving property landscape will help you to make informed decisions and secure the best possible outcome.

At Anderson Harris, we’re here to guide you through every step of the process. Contact our team today for personalised advice, and follow us on social media for the latest property market updates. Whether you’re a first-time buyer or an experienced investor, our team can help you navigate this transitional period with confidence. Get in touch today for a conversation and a tailored solution.

Betting The House

Confused about why mortgage rates aren’t dropping with the Bank of England’s base rate? Discover how swap curves and market dynamics shape fixed-rate mortgages – and why a trusted advisor can help you navigate these uncertain times.

#MortgageAdvice #SwapCurve #FixedRate

Capital & Interests: Fixed Feelings:- How Swap Curves Affect Your Mortgage

Harry Arnold 05.12.2024

Hands up if you know what a swap curve is. Not a trick question, but a tricky one, certainly.

In truth, homeowners and prospective buyers shouldn’t need an economics degree to understand the humble mortgage. At its core, the concept seems simple: rates go up, you pay more; rates go down, you pay less. But what happens when the headline-grabbing base rate (Bank of England base rate) decreases while the rate that matters to you (the fixed rate) goes up?

To understand it, let’s break down what a fixed-rate mortgage really is.

In reality, lenders don’t lend purely from their own deposits, instead they trade liquidity and capital with each other at scale, allowing them to use their balance sheets to buy large tranches of money at fixed prices, then package it up for borrowers as fixed-rate mortgages. Just like that - hey presto! - you’ve got your mortgage.

This system has worked brilliantly for the UK housing market since the 2008 financial crisis. Competitive fixed-rate mortgages allow consumers to plan their finances with some degree of stability, and reduces their exposure to the stormy seas of the Bank of England’s base rate.

Before 2008, the majority of mortgages were tied directly to this base rate, and the housing market was extremely sensitive to rate changes. A single adjustment made by the Bank of England could immediately impact monthly payments: a small but fast-moving lever, compared to the very slow, but huge hammer that’s been put down on the economy over the last two years. Has anyone else noticed that house prices have remained stable over this recent fiscal tightening cycle, without the sharp spike in repossessions and price crashes that defined the early 90s?

Here’s where the swap curve comes into play. Lenders keep an eye on the price of money in the financial markets, and use those figures to determine the rates they offer. This price, called the spread, reflects what traders believe the base rate will average over the duration of your mortgage product. It’s essentially a bet: we reckon the base rate for the next two years will be this, so the rate for your 2-year fixed mortgage should be that.

The latest chapter of these financial times has introduced further complexity to these calculations. The government has announced plans to borrow heavily to invest in infrastructure and the NHS. Although this is an important initiative, it could act as an invitation for suppliers to increase prices - there’s a willing buyer in town for manpower, cement, consulting contracts, tarmac and MRI scanners. On top of this, consider the global uncertainties stirring up concerns - the potential for a US-led trade war, for example, with the threat of tariffs pushing up prices on all goods traded between those countries or trading blocs.

So, when the prospect of inflation seems uncertain, what does the Bank of England do to keep prices stable? You guessed it. They raise interest rates - or as they like to call it: “keep rates at a sufficiently restrictive level to bring inflation back to target.”

That’s why Fixed mortgages have been rising - the market is betting that rates will come down on a slower trajectory than they thought it would a month ago. Before the government’s budget announcement, most prime mortgages were available between 3.8% - 4.5%, with a base rate of 5%. Now, despite the base rate dropping slightly to 4.75%, predictions of slower rate cuts to come have kept mortgage rates higher, hovering between 4% and 5%.

While navigating today’s mortgage market may feel daunting, a little understanding around these underlying dynamics can help you make more informed decisions, which is why a good mortgage advisor is a sensible ally to have in your corner. Fixed-rate mortgages are a valuable tool for managing financial stability, especially when times are uncertain - but if you’re considering your options, it’s always wise to sit down with a trusted advisor, who’ll help you assess the market and find the best solution for your needs.

The Balancing Act

With Labour back in power and an economy once again on the path to recovery, what could the upcoming budget mean for housing and, more specifically, your mortgage?

Capital & Interests: The Budget’s Big Test for Labour

Harry Arnold 22.10.2024

With Labour back in power and an economy once again on the path to recovery, what could the upcoming budget mean for housing and, more specifically, your mortgage?

On October 30th, Rachel Reeves will take to the lectern to deliver the first Labour budget since March 2010. That budget, titled “Securing the Recovery”, was set against a backdrop of significant financial unrest following the banking crisis. The Labour party lost the ensuing election and the rest is history. Now, the new government must deliver on its promise of economic competence and their pre-election pitch that the grown-ups are back in charge after years of stagnant growth, high taxes and - you guessed it - financial unrest.

Opinion polls will show that while parties in Downing Street and misleading parliament hurt the Conservative brand, it was when interest rates started to soar and the veneer of economic stability shattered at the mini budget, that the majority of middle Britain started to look elsewhere for someone to trust. Mortgages, as it turns out, are political dynamite - tamper with them at your peril.

This is why recent movement in the gilt market will have the Treasury on edge. The electorate that Reeves must now bring on board aren’t just high street punters - it’s the bond market itself. No shaking, only stirring please.

If gilt traders consider her spending plans too reckless, her investment strategy unsound, we can expect to see bond prices rise, pushing mortgage costs higher. Labour repeatedly used the spike in mortgage rates following the mini-budget as an attack line on the Conservatives. If history repeats itself under Labour’s watch, they’ll be on a hiding to nothing.

That said, we expect the budget to strike a balanced tone, with tax rises in capital gains, adjustments to inheritance tax, an increase in employers National Insurance contributions, and possible changes to pension and ISA allowances. This would be in aid of improved public services and plugging those black holes in the finances. Alongside these tax rises, we expect to see the government look to change the way it calculates government debt, allowing it to borrow billions more for infrastructure investment, aimed at spurring long-term growth. UK government debt relies primarily on the kindness of strangers, as we look mainly to foreign investors vs domestic buyers to purchase our bonds. Tactical recent interventions by former Bank of England governor Mark Carney and former deputy governor Andy Haldane have given credibility to this strategy, and it’s become commonplace for economists to rail against the UK’s low investment record and lack of industrial strategy — but don’t forget the mortgage. New roads and wind turbines won’t soothe angry homeowners if mortgage rates start climbing again.

At Anderson Harris, our approach is to ensure our customers are as insulated as possible from any economic volatility. If your mortgage is coming up for a renewal, lock in a new deal as early as possible; make sure you know how deep the water is, and don’t rely on a “wait and see” approach. Fiscal events can often create frayed nerves, and while governments don’t usually deliver economic pandemonium, recent years have taught us one thing: it never hurts to carry an umbrella.

Get in touch with anything mortgage related; we would be pleased to hear from you.

Some Assembly Required.

If the lessons of the past - from the financial crash to Brexit, COVID, a decade’s worth of inflation in 24 months, and a war in Europe - have taught us anything, it’s that navigating your financial journey shouldn’t be a solo mission. Frodo didn’t make it to Mordor on his tod.

Capital & Interests: Do You Really Need A Mortgage Advisor?

Harry Arnold 25.09.2024

better get the experts

I’m terrible at DIY. I have skills — I love to talk and type, but put a screwdriver in the palm of my hands and I’m all thumbs. When it comes to getting things done, I believe in getting in the experts. After all, just because you watch Kung Fu movies doesn’t mean you can do Karate.

The same logic applies to managing your finances, especially your mortgage.

The intermediary market has grown from around 50% of the mortgage market when I entered the industry in 2012 to around 89% as of today. This shift reflects how complex our financial futures have become. Banks no longer care to offer the personal advice they once did, and we’re all juggling so more financial variables: structurally higher taxes, less generous pension schemes, dual income mortgages leading to strained child care provisions, and declining birth rates leading to an ageing population, all jostling for our mental bandwidth.

we know our onions

While we can't fix any of these issues, as your mortgage advisor we can help you with one of the most significant financial decisions you’ll make: securing your home and keeping you in it. Your mortgage is your financial bedrock - we’re here to prevent it from becoming a millstone. A great mortgage advisor is worth their weight in gold, even Martin Lewis would agree. We can’t predict the future; but we can provide genuine care, support, and guidance. Wouldn't you rather have someone who loves what they do, and is enthusiastic about being your guide, rather than tackling the mountain on your own with only a meerkat for company?

During the height of Truss' budget madness, when interest rates jumped from 3% to 6% in just two weeks, the team at Anderson Harris worked round the clock to support our clients through the crisis. While we couldn’t change the financial landscape, we helped bring clarity and calm when it was needed most, leaving our customers feeling better about their finances after a conversation with their advisor, followed by decisive action and execution. Our expertise and quick action saved our clients thousands in interest costs, offering real solutions beyond the noise of unqualified "money experts" on social media who dedicate their time to making content, not advising real people or the panic of putting the problem in “too difficult to think about” box.

sunlit uplands?

So, what’s next? Elections done, inflation back near target, and rates coming down, it’s time to think ahead. We have the first Labour Budget in over a decade on the horizon and a government in search of additional revenue to change the fortunes of our public services. If the lessons of the past - from the financial crash to Brexit, COVID, a decade’s worth of inflation in 24 months, and a war in Europe - have taught us anything, it’s that navigating your financial journey shouldn’t be a solo mission. Frodo didn’t make it to Mordor on his tod.

This is where I am supposed to write a call to action. Tell your friends, tell your family, tell your neighbours, tell your plumbers that when they need their mortgage sorted they should get in touch with us at Anderson Harris. We really are very good at what we do.

The Death Of The Dinner Party Buy To Let

Is it worse to be a Landlord or a Banker in the eyes of the public? The Conservative government of the past 14 years has pulled off a parlor trick (until they didn’t), convincing the affluent middle class that they champion entrepreneurial spirit, while simultaneously imposing hefty taxes on property and specifically targeting landlords. 3% Surcharge on Stamp Duty, removal of interest rate tax relief, constant tinkering with tenancy legislation and poor economic management leading to rising interest rates. An after-dinner digestif that’s awfully hard to stomach.

Capital & Interests: How the market forced out the amateur landlord.

Harry Arnold 13.08.2024

DINNER PARTY IDEAS

Earlier in my career hardly a Monday morning passed without a new or returning customer getting in touch, asking how they might make some sort of Buy-To-Let investment. Typically, this idea had been sparked by a conversation with close friends, lubricated by the third bottle of wine on a Saturday night, and now they were ready to sober up over the financials. The dream of a passive income and a burgeoning property empire would sometimes shrivel in the cold light of day, but back then, in the era of the Dinner Party Buy-to-Let, deals went ahead.

While we’re receiving fewer inquiries from these “enthusiastic amateur” landlords, the number of those who actually go ahead with it sees an even sharper drop-off once we’ve had a chance to discuss the financial realities. To shatter the veneer of those Instagram Reels with a happy landlord staring into the sunset on a tropical beach, all expenses covered by the sixteen HMO’s they snapped up for £80k a pop in Grimsby (my wife’s hometown, HQ of my beloved in-laws), we are obliged to break down the tax regime, capital requirements, and financing costs involved in such a venture. No sunsets in sight. This leaves the enthusiastic with food for thought, and the rest running to their nearest Vanguard tracker fund.

the irony of everything

Is it worse to be a Landlord or a Banker in the eyes of the public? The Conservative government of the past 14 years has pulled off a parlor trick (until they didn’t), convincing the affluent middle class that they champion entrepreneurial spirit, while simultaneously imposing hefty taxes on property and specifically targeting landlords. 3% Surcharge on Stamp Duty, removal of interest rate tax relief, constant tinkering with tenancy legislation and poor economic management leading to rising interest rates. An after-dinner digestif that’s awfully hard to stomach. For those frustrated with the growing wealth inequality - which far exceeds income inequality - landlords have become a caricature, serving as a convenient political tool to win over disenchanted voters.

Many of the original entrepreneurial opportunists entered the market in the mid-90s, politically encouraged to do so in order to address the housing needs of a growing middle class. The government promoted Buy-to-Let as a solution to a major problem of the time - pensioner poverty. By encouraging people to take control of their own retirements in the expanding private rental market, the pressure on the welfare state would be eased. Deregulation of the sector, along with generous tax incentives suggested a new social contract: the older generation would provide homes for the young, in exchange for a stable retirement income.

These days, you would be hard pressed to find an MP who is willing to speak up for these “wealth creators”, despite the term being used by the government with frequency. With proposed capital gains tax increases in the upcoming Budget, this could be the final nail in the coffin for the Dinner Party Buy-To-Let, leaving the market split between (often harder-nosed) professional landlords and institutional investors.

A MORTGAGE MAZE

The Buy-To-Let mortgage market is now littered with bizarre products and complex criteria - the “2.59% 2-year fix with the 9% Bank fee”. Lenders offer a dizzying kaleidoscope of different products, each with varying rates, fees, and maximum loan amounts, depending on the type of landlord and ownership structure. This labyrinth is a headache for regulated advisors, and a minefield for enthusiastic amateurs, where a simple misstep could lead to huge financial errors.

With increasing regulations, complex mortgage products, and rising taxes, navigating this terrain calls for more than enthusiasm - it demands expertise. While there is still huge potential in property investment, professional support has never been more important. At Anderson Harris, we specialise in guiding both seasoned investors and those new to the market through the complexities of the property landscape, helping you make informed decisions that align with your goals. Reach out today for a conversation, and a tailored solution to your property investment.

It’s The Economy Stupid!

Capital & Interests:- What is the plan for Britain’s much maligned housing market?

As the dust settled on Labour’s landslide victory, talking heads across the UK began the inevitable task of predicting what the government may spend their initial political capital on. Having won a wide but thin mandate on a manifesto of caution and limited ambition, would they choose this moment to jolt the electorate with a series of bold but controversial policies? Yes & No.

Capital & Interests:- What is the plan for Britain’s much maligned housing market?

As the dust settled on Labour’s landslide victory, talking heads across the UK began the inevitable task of predicting what the government may spend their initial political capital on. Having won a wide but thin mandate on a manifesto of caution and limited ambition, would they choose this moment to jolt the electorate with a series of bold but controversial policies? Yes & No.

Down with the Nimbys

Planning reform doesn’t send anyone’s heart (even mine) racing but hidden behind the veil of the image of a clipboard wielding planning officer turning down your request for a larger side return, lies a fundamental shift in how the country could look and feel in 50 years’ time. Ripping up red tape is supposed to be a line from the Tory playbook, however allowing for houses to be built on “greybelt” land and alongside the return of mandated targets and newly imbued powers for Metro Mayors, means at least more houses may well get built in this parliament than did in the last.

This policy should be no surprise to anyone who read the Labour manifesto, but did many understand what it really meant? While many cry out for more homes when asked on a generalised survey, when faced with the prospect of it happening near their home, many are actually against more homes being built, let alone wind farms or train lines. Improved infrastructure has the power to link communities and bring wealth and prosperity to areas of the country that modern Britain has left behind, however many will bemoan more hard hats and cranes coming to a town near you.

Chaos under Rishi Sunak, strong & stable with Starmer?

Building a good house requires strong foundations, reliable financing and a builder you can trust. Rachel Reeves (congratulations to the first female Chancellor EVER), spent the last 2 years showcasing her credentials as a safe pair of hands and a steward of economic stability. In part the Labour party also have currently high mortgage rates to thank for their election victory, especially in the large swathes of the now crumbled blue wall. With Labour making house building a key plank of their policy platform, house builders will need confidence that young buyers will be there to actually buy these homes. This means keeping interest rates at a level where borrowers can afford to borrow. Reeves spent a good portion of her career working at the Bank of England and while she has no direct control of monetary policy she will be looking for an accommodative rate environment to help with their central growth agenda. Will Andrew Bailey and Co play ball? They will be at pains to de-politicise the bank and ‘follow the numbers' and with no growth targets within their own mandates, as long as inflation remains a threat they may keep their own powder dry longer than the government may like. However with rates already forecast to fall over the coming 12 months, the new government may have timed their coming to power to economic perfection.

What about Tax?

I have already written about the scale of inequality within the UK housing market. As economist and new Labour MP Torsten Bell writes in his new book “Great Britain?”, two ways of making sure you get on in the UK’s bonkers housing market are choosing your parents or your partner carefully. With the government making clear not to raise taxes on “working people” are they leaving the door open to other property or wealth related taxes? Re–banding council tax bands remains a rumour. What impact would this have on the value of high-end London homes and would this be tantamount to the much feared “mansion tax” touted by Ed Miliband? However, for those of you concerned about the enormous divide between the haves and the have nots, can the housing market continue to grow on the back of untaxed wealth moving from generation to generation with little to no controls?

We are a business with a sincere interest in the financial wellbeing and success of our clients and customers. We wish this government, as we would any government all success. It is important to remember, all of us are and should be on Team UK.

Mortgage Capacity Assessment Reports & Expert Financial Guidance

Divorce is an incredibly stressful and emotional experience. To achieve the best outcomes, it's important for various professionals to collaborate and offer support. We have extensive experience in producing mortgage capacity reports for use in divorce proceedings. We understand what information is relevant to the decision-making process and how to handle this sensitive topic.

Divorce is an incredibly stressful and emotional experience. To achieve the best outcomes, it's important for various professionals to collaborate and offer support.

We have extensive experience in producing mortgage capacity reports for use in divorce proceedings. We understand what information is relevant to the decision-making process and how to handle this sensitive topic.

The mortgage capacity report is intended for you and your trusted advisers to demonstrate mortgage borrowing capacity, facilitating a fair division of assets. We take the time to thoroughly discuss all details with our clients, their solicitors, and their financial advisers to ensure our assessment is fair and accurate.

From April 2022, mortgage capacity reports became mandatory for all court cases. We completely overhauled our process and the structure of our report, working with family solicitors and financial advisers to ensure that the content was relevant and concise in all cases.

When it comes to the mortgage capacity report, we must be unbiased and provide a fair assessment of mortgage borrowing. This may include multiple scenarios, or there may be no mortgage capacity at all.

We regularly work with Evelyn & Partners and their Family Team. We interviewed Lucie Spence, Partner and Director of Financial Planning at Evelyn & Partners, and asked her some questions about the topic and why the reports are important. This collaboration shows how our advice and theirs are closely connected and how we support each other in delivering excellent customer outcomes when they are most needed.

-How does a mortgage capacity assessment assist with wider financial advice in the divorce process?

Lucie: It can support the wider conversation around how much an individual would need to deposit to buy the home they are considering. It also supports the conversation around what type of house an individual can afford to purchase and the potential running costs of this property. When supporting lawyers with agreeing on a financial settlement, we go through a cashflow plan with our clients and we factor into this the level of expected borrowing and the potential interest rates to show whether this is affordable for clients. Also, it supports financial advisers in advising on a split between borrowing and investing and the right balance between the two. Should an individual wish to buy out their ex-partner from the marital home we can show the financial implications of this both in the short and longer term.

Jess: When going through a divorce, it's important to consider various outcomes. Factors such as the amount of deposit available, potential child or spousal maintenance, and cash flow planning are crucial. If one party wants to buy out the other from the family home, we can include this in the report to ensure affordability. Our reports can present different scenarios alongside cash flow analysis to illustrate the overall financial picture for the client. This helps in understanding how a mortgage loan will impact the individual both now and in the future, allowing for a fair division of assets to be agreed upon.

-What wider financial planning objectives do you consider for clients going through a divorce?

Lucie: Cash Flow planning should demonstrate how the settlement could be used to provide income or lump sums now and in the future. It also supports showing the settlement's value for the individual in terms of how long it will last at their proposed rate of spending. Financial education is vitally important for clients, and this is one of the foundations of the advice we provide. Many clients I work with have never managed their finances, so we start by talking them through the basics. Protection to cover maintenance and children costs and to replace what has potentially been lost through the divorce. Many clients have their spouses covered through their work benefits in terms of life cover, income protection or critical illness, but this is then lost when the divorce goes through Pension provision to ensure clients are making the most of their pension contributions Child Benefit ensures that the right party is claiming this benefit to ensure national insurance credits are continued. Loan repayments where possible to try and support clients to start the new chapter of their lives Investment advice, either advising on existing investments and ensuring they are structured in the right way or advising on a new cash lump sum which may have been received as a result of the divorce due to pension offsetting or a capitalised maintenance lump sum Implementing pension sharing orders which have been agreed through the court. We also have defined benefit transfer specialists who can advise when a sharing order is placed on a Defined Benefit scheme. Should the individual own a business we can provide support and advice around their options so that informed decisions can be made. Provision for children’s education

Jess: All of these broader financial planning goals will influence how we assess mortgage capacity. Factors such as education expenses, investments, and other sources of income will all affect an individual's borrowing potential. It is essential for us to comprehend how these factors will impact future mortgage capacity assessments.

-What other essential advice can you offer clients who are going through divorce and how do you help and support them in the aftermath?

Lucie: Untangling finances during a divorce can be emotional, and decisions that are made can have a long-lasting impact. Often, individuals effectively ‘pay off’ their other half just to move on with their lives and then regret this decision later when the implications become apparent. Engaging with clients as a financial adviser early on can support them in not making knee-jerk emotional financial decisions. For some clients, this may be the first time that they have managed their money and have a lack of understanding around investments or pensions. This is where we can really support financial education and the explanation going forward. We can also support the tax position when the assets are split, and the spousal exemption applies. We would also support clients going forward with their new lives and work with them to adapt their financial plans when their circumstances change. Generally, our clients have a long-term relationship with us as their financial advisers (many of mine have worked with me for over 20 years) and will meet with us at least on an annual basis, and we become their trusted advisers, often going on to advise their children.

Jess: The first time people inquire about how much they can borrow for a mortgage can be a new experience for them. For us, it's not just about creating a report for the court but also providing support afterwards. We prepare reports indicating that there is no mortgage capacity at all, which can be surprising for some people. Therefore, it's important for us to support and educate them, explaining how and why we reached our conclusions so they can move forward confidently and with understanding.

-How can this information prove valuable in negotiating a divorce settlement's property division, spousal support, and other financial aspects?

Lucie: Working with legal professionals & using the mortgage capacity report to understand how much an individual can afford to buy a new property and ensure that they have enough income or capital to fund their lifestyle going forward is an important part of the process. We can also help to discuss with the client whether or not this is realistic over the longer term or whether they need to have a larger settlement, borrow less or reduce their outgoings. Should an individual receive a capital lump sum instead of ongoing maintenance, we can calculate the capital amount depending on the client's risk level. We also work with clients' legal representatives to determine how much income can be generated from varying lump sums. We explain the value of money to individuals and evidence how much disposable income they would have depending on the mortgage level they take out and the impact of rising or falling interest rates. This can then support the clients and legal professionals with the negotiation, and we can run the calculations required depending on their requirements. It also shows where suggested settlements are not affordable to an individual and the impact on them in later years. For example, when an individual keeps a marital home but doesn’t have any pension provisions, we can work with them to understand the changes that will need to occur in their later years to afford their retirement.

Jess: The first part of the report emphasises the importance of taking into account various aspects when undergoing a divorce. It underscores the significance of professionals working together to provide the required information for a fair evaluation of the situation and the division of assets.

We are committed to providing personalised, compassionate customer service at the heart of everything we do at Anderson Harris. Divorce is a challenging time for everyone involved, and we strive to offer necessary support in a timely and sensitive manner. Many of our clients initially approached us for a mortgage capacity report and have since become long-term clients. We also collaborate with their other professional advisers. If you would like to discuss any of the topics mentioned in this blog, please reach out to us. We are more than happy to assist in any way we can, including providing referrals to relevant services.

Beyond Avocado Toast

In the UK, our home is our castle, and this cornerstone of British life is in many ways our unique obsession. But if home ownership is so popular, economically beneficial, and politically supported, why has it become so difficult for those who do not own a home to go out and buy one? In chapter two of our Capital and Interests series we ask what we have to do to be considered worthy of home ownership?

Capital & Interests: The Changing Face of the UK Mortgage Scene

Harry Arnold 04 06 2024

a tasty problem

In the UK our home is our castle, and this cornerstone of British life is in many ways our unique obsession. But if home ownership is so popular, economically beneficial, and politically supported, why has it become so difficult for those who do not own a home to go out and buy one? In chapter two of our Capital & Interests series we ask what we have to do to be considered worthy of home ownership and what are the growing number of innovations in the mortgage market that have arrived on the scene to help more of us get there?

Cancelling your Netflix subscription and cutting back on avocado toast probably won’t do it, despite this song being sung at those under the age of 40 for some time now. The truth is that those unable to draw on significant support from their family, or those without abnormally high salaries, are being priced out in a market that exemplifies the economics of “the haves and have nots”.

The UK property market, worth an estimated eight-trillion pounds, holds a significant portion of the country’s wealth. The people holding that wealth have little desire to give it up, and any political party that suggests they might is swiftly told by the electorate to please think again. The old economic battleground of Baby Boomers vs Millennials is beginning to give way to an even more nuanced confrontation: Millennials with an inheritance, and Millennials without.

So, what’s being done to level the playing field? It’s probably going to take an extended period of fundamental reform to help the UK escape stagnation and enter an age of equality and prosperity, where our wages increase above the rate of house price inflation, and peace and love is extended to all. In the meantime, innovation in the mortgage market will have to do.

Luckily, help is at hand, thanks to a growing family of products designed to help Generation My-Landlord-Is-Upping-My-Rent. From Ultra Long Mortgage Terms to trendy Scandi style loans, a new generation of mortgage products is hitting the market.

What is new on the shelves?

The Track Record Mortgage hit the shops from Skipton Building Society in May 2023. It’s a simple option, allowing for a 100% mortgage with no deposit, as long as your mortgage payment is no higher than the rent you currently pay. When making a credit decision, this option takes into account your performance as a renter, which is fairly unique amongst retail lenders. You’ll still need to adhere to Skipton’s strict lending criteria, have a picture perfect credit rating and if you’re living at Mum and Dad’s, this one isn’t for you.

The 5k Deposit Mortgage is the most recent offering from Accord Mortgages, only launched a couple of months ago. This option allows for someone to borrow with a minimum £5k, or 1% deposit, on a maximum purchase price of £500,000. No flats allowed, and an immaculate credit score is required. This option is great for anyone who’s saved up some money by moving back in with Mum and Dad, but also have a quality job to lean on, driving affordability for the mortgage itself.

The thing that sets these two apart from the more traditional Joint Borrower Sole Proprietor offered by several larger banks, is that they are focused on the worthiness of the individual, rather than relying on parents participating in the mortgage, or putting their money on deposit with the bank - as we see with the Family Springboard Loan offered by Barclays. An honourable mention also to the Dutch, with newcomers April Mortgages and Perenna bringing Long Term Fixed Rate options that may well be a superb option for those who want to go big on the borrowing with no exposure to the rate market.

Although it’s exciting to see these products coming out, offering innovative solutions - it’s important to note that they are provided by small institutions. They’re not currently being offered by the big banks with their big boy balance sheets - and until they start to get on board, the dial is unlikely to shift dramatically.

how we can help

It’s a long road to a more accessible housing market, but these innovative products offer stepping stones for aspiring homeowners. Perhaps, with continued innovation and a focus on individual merit, the dream of homeownership could become a reality for a wider segment of the population.

Navigating these choppy waters is challenging, and as always advice is critical when you’re seeking any mortgage, especially if you’re diving in for the first time. Reach out for a conversation with a member of our team today.

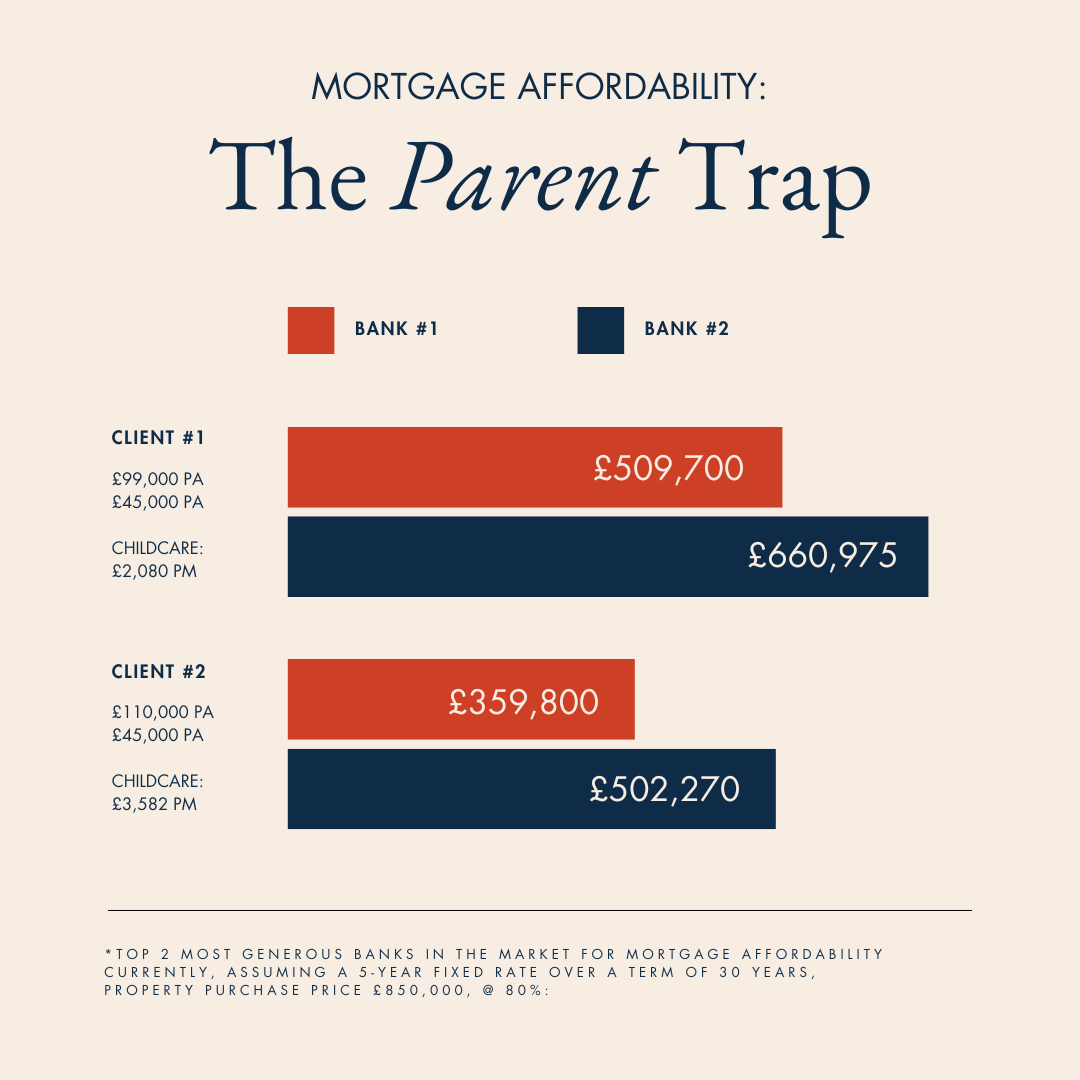

The Parent Trap

Last month’s widely publicised rollout of the government’s ‘free childcare’ offering contains a clause that many hard-working families are likely to find frustrating and disappointing, given the considerable financial strain the cost of childcare puts them under; the exclusion of any and all support if one parent earns over £100,000. No tax-free childcare, and no free hours until the child reaches 3.

Capital & Interests: The creation of the ultimate frozen threshold.

Harry Arnold 14 05 2024

WHAT is going on?

My wife works in public policy, and I’ve learnt to look forward to her nightly report, in which she offers me some insight into the way various government sausages are made. It appears creating policies that make everyone happy is either impossible, highly implausible - or completely unaffordable. In this first instalment of Capital & Interests, it’s the subject of affordability that I’d like to shine a light on.

Last month’s widely publicised rollout of the government’s ‘free childcare’ offering contains a clause that many hard-working families are likely to find frustrating and disappointing, given the considerable financial strain the cost of childcare puts them under; the exclusion of any and all support if one parent earns over £100,000. No tax-free childcare, and no free hours until the child reaches 3.

£100,000 is a large annual income, and perhaps you’re of the belief that it’s not the responsibility of the taxpayer to support the richest among us. But although £100,000 sounds like a lot of money, let’s consider it within the context of a London housing market gone mad, where people are expected to find half-a-million to buy a garden flat with rising damp and poor transport links . £100,000 just isn’t what it used to be.

This is especially true if you don’t count yourself among the growing number of millennials inheriting baby boomer wealth. These days, this cohort could be looking down the barrel of a fairly large mortgage, in an elevated interest rate environment, to buy a pretty standard house south of Watford. For a generation born into the “End of History”, who have likely followed the New Labour path through university in order to secure a “high paying job of the future”, this is a fairly bitter pill to swallow. Let’s not forget their student loan payments, currently sitting at 7.8% for a plan 2 loan.

HISTORY

It was the late Alastair Darling - as I write this, the last Labour Chancellor - who introduced the £100,000 threshold in 2009, when it was decreed that anyone earning over this sum would start being denied a personal allowance, thus creating the dreaded 60% tax rate and it has not moved an inch since. According to Nationwide’s House Price Calculator, in the fifteen years that have passed since this decision, house prices in London have risen by 102% and according to the Bank of England’s own Inflation Calculator, goods and services that would have cost you £100,000 in 2009 will now cost you £153,670. This is the ultimate frozen threshold.

the effect

After an internal analysis of the two banks who currently have the most generous affordability calculations on the high street, we also found that this removal of support has a profound impact on mortgage affordability for higher earners. If you’re receiving no government support, an example cost of full-time nursery based in a South London borough (mine, actually) for two children under the age of three comes in at £3,528 per month.

For a partner of someone exceeding the £100,000 threshold, assuming they make a 5% pension contribution and have a plan 2 student loan, this £3,528 figure is the rough equivalent of the net monthly salary of £64,000 per annum. The uncomfortable reality is that unless the second earner exceeds this level of salary, there’s little point in them working and the family committing to these childcare costs. Another striking point with regards to mortgage affordability is that in our model, only when someone is earning £145,000 and not receiving the benefits would they be able to borrow more than someone earning £99,000 and receiving their full childcare benefits. That’s a 46% gap.

This is a metropolitan problem, yes - but it’s one being faced by the people in our society that we hold up as aspirational role models. Hard-working families, making it on their own with little to no parental support. High-earners who have worked their way up to a “high paying job of the future”, and, with house prices where they are, significant mortgages.

how we can help

As we navigate the market, it’s increasingly obvious that generic solutions rarely meet specific needs. At Anderson Harris, we understand unique circumstances, and we’re committed to providing bespoke financial solutions that align with your needs. Whether you’re grappling with the challenges of mortgage affordability, or seeking strategic advice on how to manage your finances amidst new policy changes, our team is here to guide you.

Reach out for a conversation with one of our advisors today, so we can explore the options available, and discuss how we can tailor our services to support you.

Your Journey Home Starts Here

Discover how we at Anderson Harris simplify your mortgage journey with expert guidance and personalised service. Our revamped approach ensures a stress-free experience, letting you focus on the joys of home ownership. Explore our bespoke solutions today.

At Anderson Harris our approach to client service is simple yet impactful: from the initial consultation to the successful securing of their mortgage and beyond, we ensure a smooth, understandable, and bespoke experience tailored for every individual. Our goal is a stress free process for the time poor, where our clients can focus on the joys of home ownership, while we take care of the financial essentials.

A fresh look, same approach

While our focus remains fixed on the ongoing financial success of our clients, after thirteen years in the market we felt it was time for a refresh of our brand, making sure that how we look and feel, reflects the standards we set ourselves in delivering for borrowers every day. We also want to take this opportunity to reaffirm to you, our clients and counterparties, that our core values of competence, transparency and decency remain the cornerstone of our offering to the market. Our rebrand marks the start of a new chapter for our firm. With your support, we feel it is time for our offering to reach more people, so more of them can get the award winning, highly respected advice that so many of you and your clients already experience.

What to expect from us?

What is required to be an advisor in the digital world of 2024? With so much swirling information around mortgages and its place in our economy, our enhanced digital offering will be a calming tonic to the noise. With a new generation of borrowers looking to seek guidance online, expect to see more client-centric insights, explainers & tips from us across multiple platforms, so that more borrowers can access the quality advice they deserve. We will be there as a regulated, professional voice, talking about topics that relate to our clients financial lives and requirements, nothing else.

Our Rebrand Reflects Our Commitment to You

Our recent rebranding is a reflection of our commitment to being by the side of every client throughout their mortgage journey, not only from transaction to transaction, but also as an ongoing source of useful, relevant mortgage news and editorial commentary. The new look and feel encapsulates our ethos of clarity, trust, and personal guidance.

The journey, together

Choosing Anderson Harris means choosing a partner whose determination to succeed mirrors the home ownership dreams of our clients. Take a look at our process, and send us an email to learn more about how we can help you navigate paths to homeownership with ease and confidence.

Call us today on 020 7495 6633 or email enquiries@andersonharris.co.uk.